vermont state tax department

Ad New State Sales Tax Registration. IN-111 Vermont Income Tax Return.

To request exemption of tax because the tax was paid to another state the vehicle was received as a gift the vehicle is equipped with altered controls or a mechanical lifting.

. Freedom and Unity Live. Vermont School District Codes. In addition to personal business.

The Department will begin processing. Vermont Fish and Wildlife Find information apply for licenses and permits and learn about. Below you will find information about the various taxes for businesses and corporations operating in Vermont.

PA-1 Special Power of Attorney. Click here for phone number s Local. Check My Refund Status.

Ad Get Ready for Tax Season Deadlines by Completing Any Required Tax Forms Today. Vermont roads are some of the most scenic in the country and we issue a wide variety of license and identification types. Download or Email VT SUT-451 More Fillable Forms Register and Subscribe Now.

Generally the Department processes e-filed returns in about 6-8 weeks while paper returns typically take about 8-12 weeks. To request exemption of tax because the tax was paid to another state the vehicle was received as a gift the vehicle is equipped with altered controls or a mechanical lifting. Vermont Department of Motor Vehicles 120 State Street.

No additional tax will be due if the tax paid on an out-of-state registered vehicle was equal to or more than the Vermont tax rate. The Vermont Department of Taxes serves Vermonters by collecting about 30 state tax types to pay for the goods and services people receive from the state. Additional information to help you with understanding property taxes including how to appeal your property taxes can be found on the Secretary of States website.

802 828-2865 Toll Free. Send us a Message. Vermont Tax Department information registration support.

Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont. Vermont State Parks Explore our state parks and immerse yourself in the beauty of Vermont. If you are doing business in Vermont you are likely.

Vermont Department of Taxes. The Vermont Department of Taxes offers several eServices for individual taxpayers and businesses through myVTax the departments online portal. W-4VT Employees Withholding Allowance Certificate.

Business Tax Center Find guidance on paying taxes as a business in Vermont.

Publications Department Of Taxes

Vt Dept Of Taxes Vtdepttaxes Twitter

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Department Of Taxes Notice Of Changes Sample 1

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Sales Tax Small Business Guide Truic

Vt Dept Of Taxes Vtdepttaxes Twitter

Individuals Department Of Taxes

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vt Dept Of Taxes Vtdepttaxes Twitter

Vermont Department Of Taxes Issuing 1099 Gs For Economic Recovery Grants And Taxable Refunds Department Of Taxes

Vt Dept Of Taxes Vtdepttaxes Twitter

Where S My State Refund Track Your Refund In Every State

Vermont Department Of Taxes Notice Of Changes Sample 1

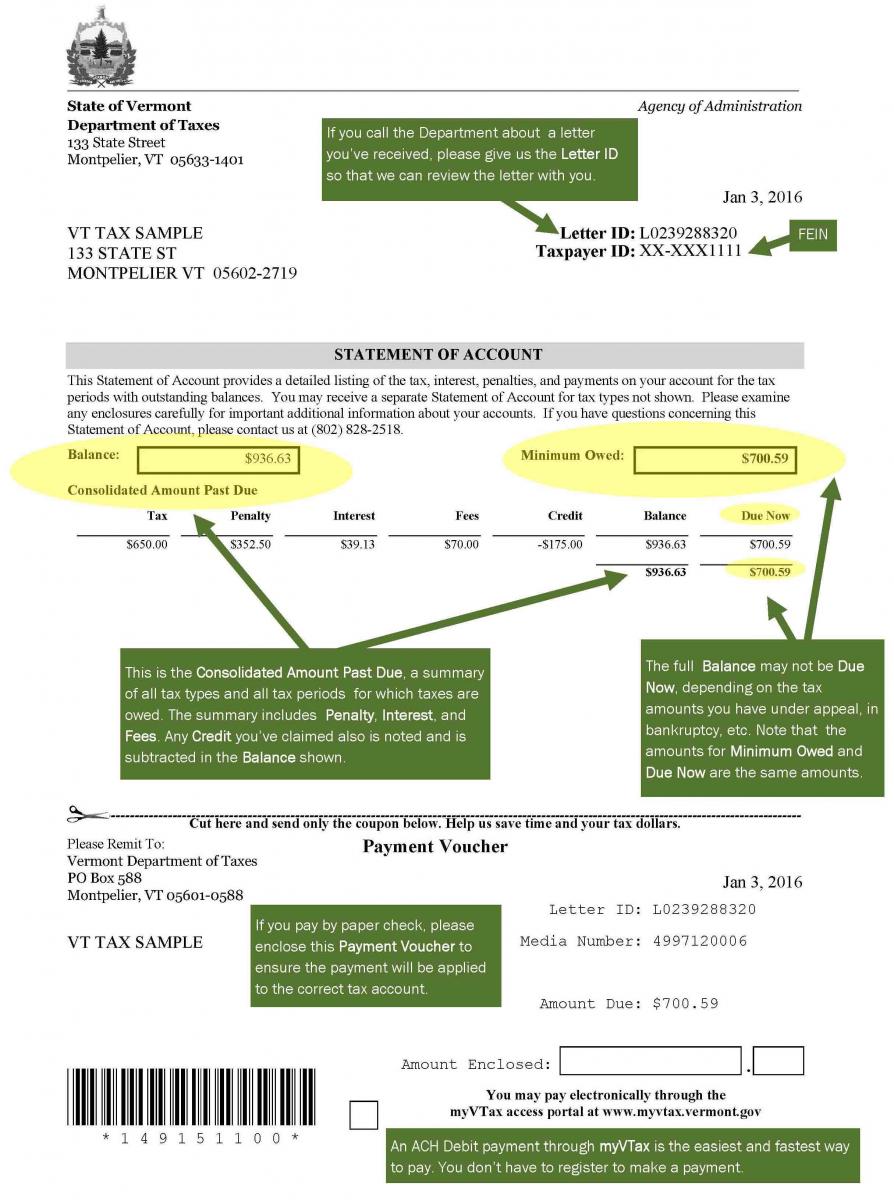

Your Tax Bill Department Of Taxes